Properties

- Singapore

- China

- Indonesia

- United Kingdom

- » Middlewood Locks, Manchester

- » Endeavour, Sheffield Digital Campus, Sheffield

- » 5 Chancery Lane, London

- » Purpose-built Student Accommodation

- Australia

- Investments

- Past Projects

Portfolio of Six Purpose-built Student Accommodation

In December 2020, Metro established a purpose-built

student accommodation (“PBSA”) fund, Paideia Capital UK

Trust (“Trust”) through a newly formed strategic partnership

with Lee Kim Tah Holdings Limited and Woh Hup Holdings

Pte Ltd, to expand and diversify further in the United

Kingdom. Metro and its joint venture partners incorporated

Paideia Partners Pte. Ltd. to act as fund manager to grow its

fund management arm.

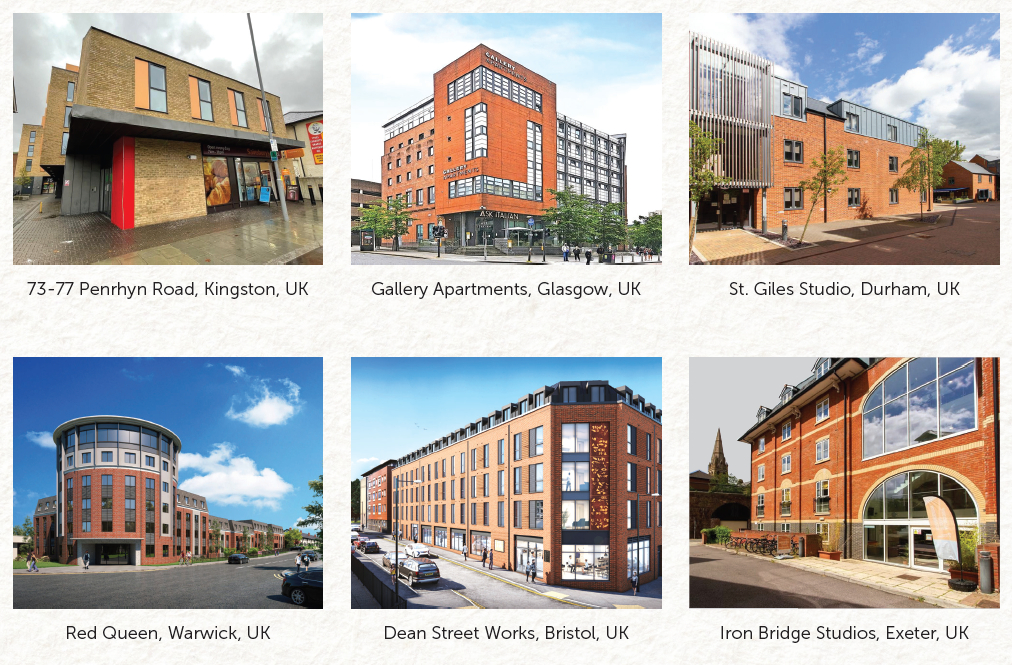

Upon the First Closing of the fund, the Trust acquired its first PBSA seed property in Warwick for a total consideration of £21.5 million (approximately S$38.7 million). In January 2021, the Trust acquired its second asset in Bristol – Dean Street Works, for a total purchase consideration of £30.1 million (approximately S$54.8 million). In May 2022, the Trust completed its acquisition of the next four PBSA properties in Durham, Exeter, Glasgow and Kingston for a total consideration of £74.4 million (approximately S$119.0 million).

The total portfolio of six PBSA properties was valued at £149 million (approximately S$259 million) and achieved a committed occupancy rate of 99.3% as at 31 March 2025.