Properties

- Singapore

- China

- Indonesia

- United Kingdom

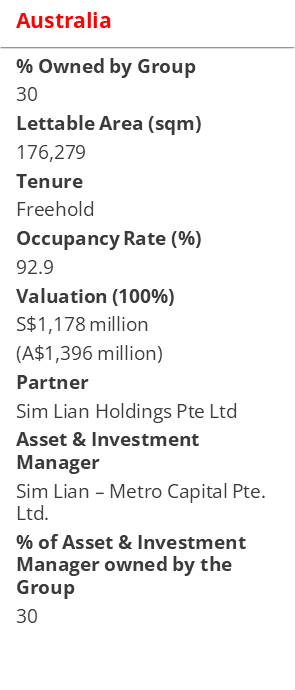

- Australia

- » Portfolio

- Investments

- Past Projects

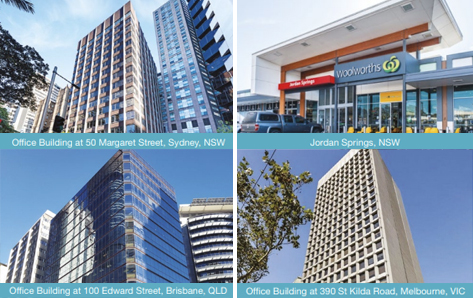

Portfolio of 17 Office & Retail Properties in Australia

In November 2019, Metro expanded its regional footprint

by investing 20% in a joint venture with Sim Lian that owns

a portfolio of 14 quality freehold properties comprising four

office buildings and 10 retail centres that span across four

key states in Australia, namely New South Wales, Victoria,

Queensland and Western Australia. The four office buildings are

strategically located in the core CBD of Sydney and Brisbane

and the fringe CBD of Melbourne and Perth. The other 10 retail

centres are located regionally with over 90% of the retail space

being anchored by defensive non-discretionary retailers such

as supermarkets that cater to day-to-day necessities of the

community within the primary residential catchment area. The

joint venture has since grown its presence in New South Wales

with the acquisitions of Ropes Crossing Village Shopping

Centre in November 2020 and Cherrybrook Village Shopping

Centre in October 2021. Following these acquisitions, Metro

increased its equity stake in the Australian portfolio from 20%

to 30%.

Further expanding its retail footprint, the joint venture acquired Shepparton Marketplace in Victoria in September 2022. Most recently, in October 2024, the joint venture added 1 Castlereagh Street, a prime office property located in the financial core of Sydney’s CBD. The Australian portfolio, with a total appraised value of A$1.4 billion (approximately S$1.2 billion), has an occupancy of 92.9% and a WALE of approximately 5.0 years by income as at 31 March 2025.

To align the interest with its strategic partner, Sim Lian, and to grow its asset management arm, the Group invested a 20% equity stake in an asset and investment management company namely, Sim Lian – Metro Capital Pte. Ltd., in November 2019 to manage the portfolio in Australia. In October 2021, Metro stepped-up its equity stake to 30%.